Financial Charismatics: Language, Memes and the Seduction of (New) Money

Charisma – a word used to describe an allure that inspires devotion, its charm originally understood as a form of divine gift. As we navigate the pataphysical absurdities of global finance, how does broad devotion these systems (old and new), speak to the charisma of their visual, spoken and written rhetorics?

Moderated by Monique Rooney, this session brings together Ceri Hann, Melinda Cooper, Jack Parkin, Justin Clemens and Ellie Rennie, to explore the language, memes and seduction of money.

The session will be livestreamed on this page at 1:00pm AEST, Friday 6th November at https://economythologies.network/. Following the event, the video recording of this session will be available for viewing on this page.

Monique Rooney

Monique is a Senior Lecturer in English at the Australian National University. Her research explores race, sex, gender and class in the context of the longue durée of melodrama as an aesthetic form persisting from the Enlightenment age to the present. Her book Living Screens: Melodrama and Plasticity in Contemporary Film and Television (Rowman and Littlefield International 2015) is the culmination of research which draws on thinkers ranging from Jean Jacques Rousseau to Marshall McLuhan and Catherine Malabou in order to explore melodrama as a highly adaptable and durable mode that mutates as it crosses modalities and media.

Monique is the editor of Australian Humanities Review, who recently edited a special edition on ‘Cryptocurrency and the Intelligence of the Humanities.’

Ceri is a multidisciplinary arts practitioner who develops participatory art forms intended to enhance the conditions for collective idea generation. This approach to practice often avoids categorisation, as the outcomes are intentionally defused in the wonder/wander of everyday life.

The gifting of metaphorical objects to instigate philosophical discourse stems from Ceri’s recently completed PhD research at RMIT, ‘the making of a Knowledge Casino’ (2016).

Over the past ten years Ceri has been a sessional tutor and guest lecturer in the RMIT School of Art and School of Architecture and Design and has an ongoing engagement within the Art in Public Space and MFA post-graduate programs. Ceri has presented work at Gertrude Contemporary (2019), Melbourne Comedy Festival (2017), Liquid Architecture (2015), RMIT Project Space (2014) and run workshops at West Space, Blindside Sound Series and Testing Grounds.

Public Money and the Theatrics of Austerity

Left and right libertarians have spent the last few years obsessing over the emancipatory possibilities of a purely private creation of money, beyond the reach of the state and central bank. But while libertarians were dreaming of digital gold, central banks were embarking on the most spectacular acts of public money creation the world has ever seen, mustering unheard of powers of intervention on behalf of private wealth. The irony was already visible after the global financial crisis, when central banks stepped in to salvage a nominally private shadow banking system with the help of billions of dollars in asset purchases. But the experiment has been carried much further as a result of COVID 19 which has plunged us into a new and (for some) embarrassing reality: a de facto economic communism that nevertheless remains wedded to the prerogatives of private wealth. For almost a year now, we have lived in a world in which whole swathes of the economy have been kept alive with the help of public debt and money creation. Now that coronavirus has forced every economy in the world onto public life support, and investors are clamouring to buy debt at near zero interest rates, governments have been definitively liberated from the competitive market discipline that loomed over public spending decisions in the past. Yet governments have continued to act as if their spending decisions were selectively constrained by virtually non-existent market forces.

This paper seeks to shift the activist imagination away from digital gold towards a radical public economics. With reference to the recently released budget, it asks how we might seize (back) the means of public debt creation and how industrial action could be imagined in a more offensive vein as a way of instigating and forcing through more and better investment in an expanded public sector.

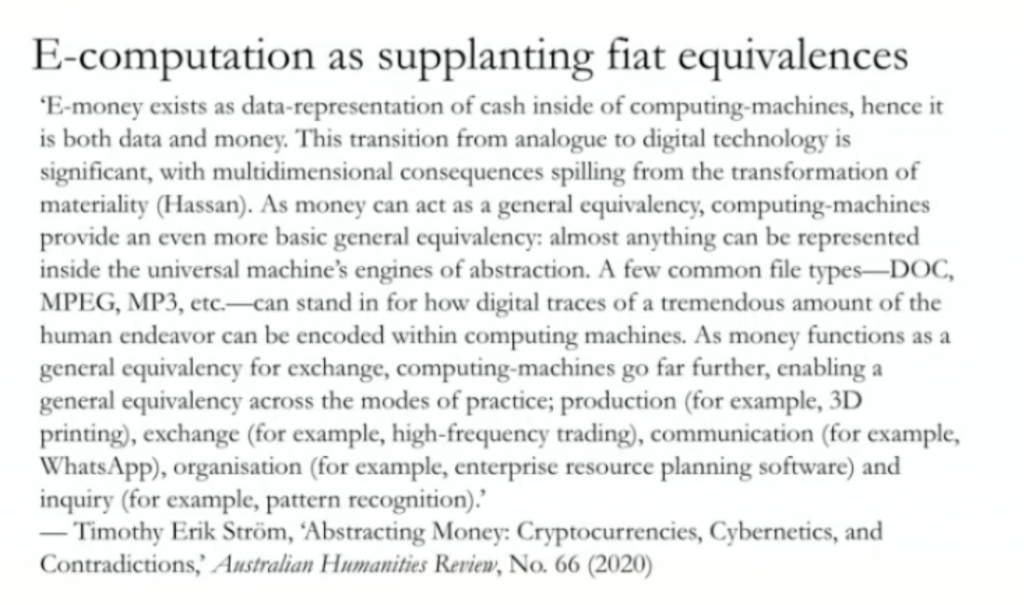

The question concerning ‘real abstraction’ has been important to modern philosophy and sociology, particularly in its Marxist-inflected traditions. Such thinkers as Georg Simmel, Alfred Sohn-Rethel, and Theodor Adorno have contributed to its discussion, and it is ‘no accident’ (as such thinkers also like to put it) that the category emerges from and focuses upon the role of money under capitalism as both ‘general equivalent’ and a systematic distraction from the expropriative machinery of the production of value. The ‘abstraction’ — that labour is dissimulated by commodities which enter into exchangeability by means of another agent, money, which further reifies their substance — is ‘real’ because it is directly part of social practices themselves, no matter what ideas we may have about such practices. Something however seems to be significantly different following the development of cryptocurrencies like Bitcoin which, although highly technical and stunningly abstract, are often expressly directed against existing social practices of exchange. In this talk, I would therefore like to discuss these new developments under the heading of ‘unreal abstraction’ (which is also a kind of ‘imaginary subtraction’), based on algorithmic processes that seek to automate and decouple the production of value from all social forms.

In the emerging area of DeFi (decentralised finance), automation is integral to the workings of financial infrastructures, enabling decentralised trading exchanges and, in some instances, helping to produce stable assets. These systems incentivise people to contribute to liquidity pools, which are necessary for automated market-maker (AMM) algorithms and some stable coins to work effectively. Games and memes play a key role at frontier of finance, creating knowledge clubs with compounding layers of risk and profit for those willing to participate. Within a few short months, DeFi has also tested various mechanisms for fairer and more transparent economic systems via rapid experiments in power and capital. In this presentation, I will sketch preliminary insights from my ethnographic research, including the significance of the ‘peer-to-contract’ model for algorithmic governance.

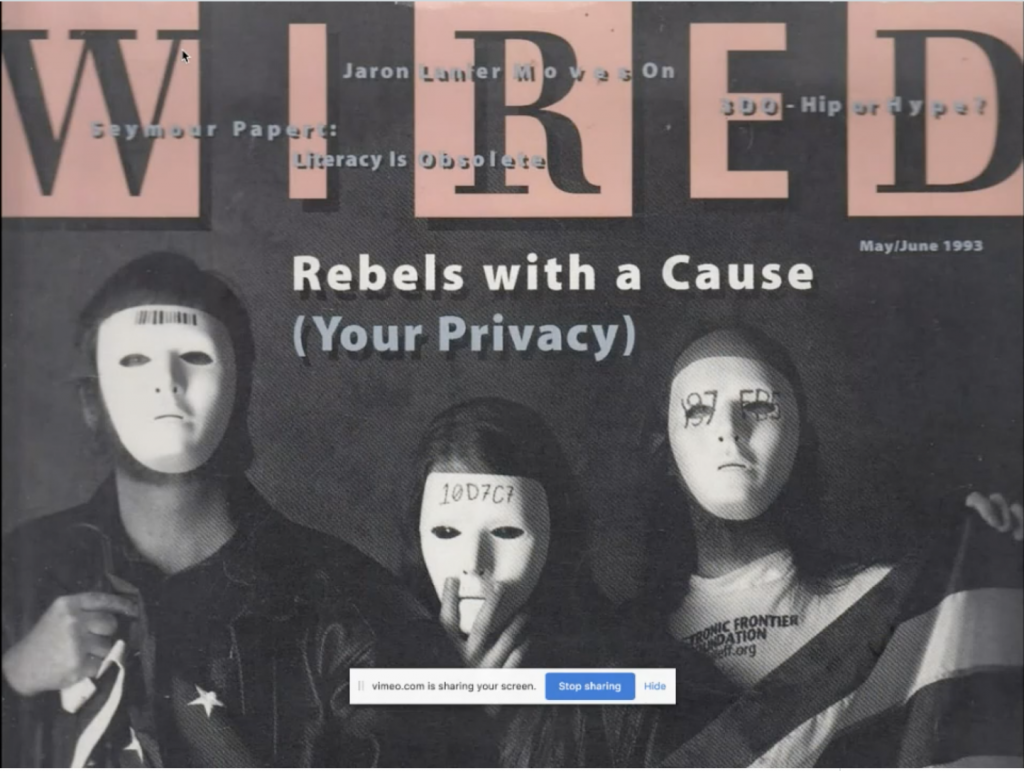

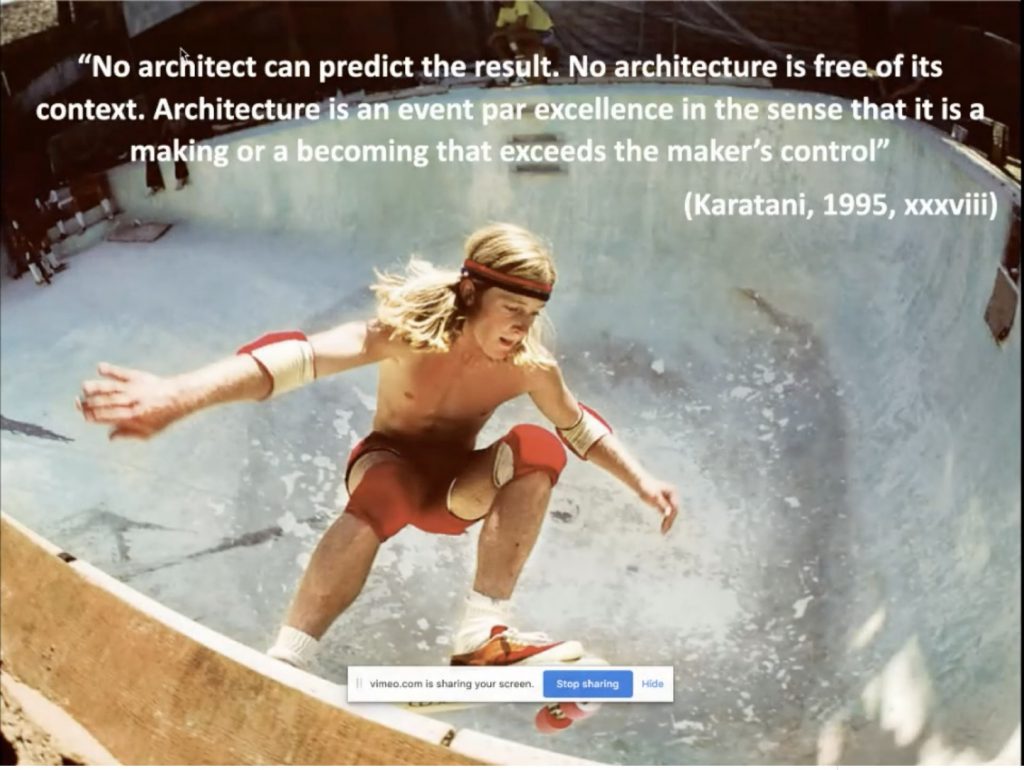

Architects have long imbued their blueprints with utopian ideals in an attempt to make the world a better place. Yet creators can never wholly control their creations, leading to a slippage between imagined worlds and how they play out in practice. Today, this persistent problem is befalling the digital architects of modern money. Blockchains are intricate software models built to direct economic interaction in a more “desirable” fashion. Their architectures can supposedly bring about a decentralised and democratic financial landscape free from the coercive control of centralised institutions like commercial and central banks. A powerful rhetoric is employed to push this vision into a material reality. However, at the same time, a dislocation emerges between the language of decentralisation and its tangible application. This talk will address the many myths of decentralisation that have accompanied the growth of blockchains, and demonstrate how these mythologies work to (mis)shape their economies.